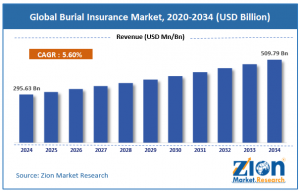

Burial Insurance Market Projected to Grow from $295.63B to $509.79B by 2034

The global Burial Insurance Market was valued at approximately USD 295.63 billion in 2024 and is expected to reach around USD 509.79 billion by 2034

The global burial insurance market was valued at approximately USD 295.63 billion in 2024 and is expected to reach around USD 509.79 billion by 2034”

PUNE, MAHARASHTRA, INDIA, August 7, 2025 /EINPresswire.com/ -- 📊 Market Overview— Deepak Rupnar

The global burial insurance market was valued at approximately USD 295.63 billion in 2024 and is projected to reach around USD 509.79 billion by 2034, registering a compound annual growth rate (CAGR) of 5.60% between 2025 and 2034. This growth is fueled by an aging global population, rising funeral and cremation costs, and increasing awareness of end-of-life planning.

Access key findings and insights from our Report in this sample - https://www.zionmarketresearch.com/sample/burial-insurance-market

Also known as final expense insurance, funeral insurance, or pre-need insurance, burial insurance provides financial coverage for funeral-related costs including burial, cremation, casket purchase, headstones, transportation, and memorial services. It plays a critical role in protecting families from the financial burden of death expenses, offering peace of mind and financial security during emotionally difficult times.

Regional Market Analysis

1. North America (Largest Market Share)

Market Size (2024): ~USD 112.34 billion

Projected Market Size (2034): ~USD 189.25 billion

CAGR: ~5.8%

Key Drivers:

High funeral costs averaging $7,000-$12,000

Growing senior population (65+ years)

Strong insurance penetration and awareness

Leading Countries: U.S. (90% share), Canada

2. Europe (Mature Market)

Market Size (2024): ~USD 87.21 billion

Projected Market Size (2034): ~USD 145.33 billion

CAGR: ~5.7%

Key Drivers:

Aging populations in Germany, UK, France

Rising preference for pre-planned funeral arrangements

Government support for senior welfare programs

Leading Countries: Germany, UK, France, Italy

3. Asia-Pacific (Fastest-Growing Region)

Market Size (2024): ~USD 62.45 billion

Projected Market Size (2034): ~USD 115.72 billion

CAGR: ~6.9%

Key Drivers:

Rapidly aging populations in Japan, China

Increasing middle-class awareness

Cultural traditions emphasizing proper burials

Leading Countries: Japan, China, South Korea, India

4. Latin America (Emerging Growth)

Market Size (2024): ~USD 18.54 billion

Projected Market Size (2034): ~USD 32.16 billion

CAGR: ~6.2%

Key Drivers:

Growing insurance penetration

Rising funeral costs in urban areas

Expanding middle class

Leading Countries: Brazil, Mexico, Argentina

5. Middle East & Africa (Developing Market)

Market Size (2024): ~USD 15.09 billion

Projected Market Size (2034): ~USD 27.33 billion

CAGR: ~6.5%

Key Drivers:

Improving insurance infrastructure

Rising awareness of burial planning

Urbanization trends

Leading Countries: South Africa, UAE, Saudi Arabia

Key Insights:

As per the analysis shared by our research analyst, the global burial insurance market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2025-2034)

In terms of revenue, the global burial insurance market size was valued at around USD 295.63 billion in 2024 and is projected to reach USD 509.79 billion by 2034.

The burial insurance market is projected to grow significantly due to the increasing elderly population worldwide, rising funeral costs, growing awareness of end-of-life financial planning, and simplified insurance product offerings.

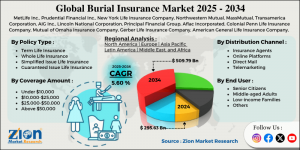

Based on policy type, whole life insurance leads the segment and will continue to lead the global market.

Based on coverage amount, policies between $10,000 and $25,000 are expected to lead the market.

Based on the distribution channel, insurance agents are anticipated to command the largest market share.

Based on end-users, senior citizens are expected to lead the market during the forecast period.

Based on region, North America is projected to lead the global market during the forecast period.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.zionmarketresearch.com/custom/9551

🔍 Market Dynamics

✅ Key Growth Drivers

Aging Global Population 👴👵

Rising life expectancy and growing senior populations in regions like North America, Europe, and Asia-Pacific are driving higher demand for burial insurance policies tailored to retirees.

Rising Funeral & Burial Costs 💸

Average funeral expenses have skyrocketed globally, reaching $7,000–$12,000 per funeral in some markets. Burial insurance is increasingly used to offset these burdens.

Growing Awareness of End-of-Life Planning 🧾

Increasing discussions around death preparedness, estate planning, and will creation are promoting burial insurance as a vital tool.

Affordable Premiums & Simplified Underwriting 📑

Burial insurance plans typically feature no medical exams, small premiums, and guaranteed acceptance—making them attractive to lower-income and senior customers.

Cultural Norms & Religious Obligations

In many regions, traditional burial practices are a societal and religious necessity, further fueling the need for financial products like burial insurance.

❌ Market Restraints

Limited Coverage Amounts

Most burial insurance plans offer modest benefits (USD 2,000–25,000), which may not be sufficient in high-cost regions.

Lack of Awareness in Emerging Markets

Developing nations may lack education or access to burial insurance options, limiting market penetration.

Overlap with Life Insurance Products

Some consumers opt for term or whole life insurance instead, which may cover funeral expenses and offer broader financial benefits.

🧾 Market Segmentation

🏷️ By Type:

Pre-Need Insurance

Sold through funeral homes, tied directly to funeral service providers.

Final Expense Insurance

Sold directly to individuals by insurers or agents; beneficiaries use the payout for any funeral-related costs.

💼 By Age Group:

50–65 Years

66–75 Years

76+ Years

🧍 By Premium Type:

Level Premiums (Fixed for policy term)

Graded Premiums (Increasing over time)

Modified Premiums (Lower early payments)

🌐 By Distribution Channel:

Insurance Agents/Brokers

Funeral Homes

Online Direct-to-Consumer Platforms

Bancassurance

Affinity Groups & Unions

📍 By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

🌍 Regional Insights

🇺🇸 North America – Market Leader

Driven by high funeral costs and strong awareness campaigns.

The U.S. alone accounts for a substantial portion of global burial insurance sales.

Growth supported by providers like Mutual of Omaha, AIG, Lincoln Heritage Life, and Colonial Penn.

🇪🇺 Europe – Rising Adoption

Increasing number of seniors, especially in Germany, Italy, and the UK.

Countries like Spain and France also showing strong adoption due to cultural funeral norms.

🌏 Asia-Pacific – Emerging Growth Frontier

Japan’s aging population is a major growth factor.

Rising income levels in India, China, South Korea, and Southeast Asia promote funeral planning awareness.

🌎 Latin America & MEA – Gradual Uptake

Still developing due to lower penetration of insurance products.

Culturally strong community funeral traditions may reduce private coverage demand, though urbanization is changing this trend.

Inquiry For Buying-https://www.zionmarketresearch.com/inquiry/burial-insurance-market

🏢 The global burial insurance market is led by players like:

MetLife Inc.

Prudential Financial Inc.

New York Life Insurance Company

Northwestern Mutual

MassMutual

Transamerica Corporation

AIG Inc.

Lincoln National Corporation

Principal Financial Group

Aflac Incorporated

Colonial Penn Life Insurance Company

Mutual of Omaha Insurance Company

Gerber Life Insurance Company

American General Life Insurance Company

Banner Life Insurance Company

Foresters Financial

Liberty Mutual Insurance

State Farm Life Insurance Company

Allstate Life Insurance Company

AARP Life Insurance Program.

These players focus on streamlined digital applications, tailored policies for seniors, and partnerships with funeral homes and religious institutions.

📅 Market Forecast (2025–2034)

Year Market Size (USD Billion)

2025- 311.21

2026- 328.65

2027- 346.96

2028- 366.20

2029- 386.44

2030- 407.76

2031- 430.23

2032- 453.94

2033- 478.97

2034- 509.79

🧠 Key Trends & Innovations

AI & Digital Platforms

Use of AI-based underwriting, chatbot advisors, and mobile apps is simplifying policy enrollment and customer engagement.

Bundled Funeral Plans

Burial insurance now frequently bundled with funeral service packages, offering pre-planning benefits and price locks.

Green & Eco-Friendly Burial Options 🌱

Demand for biodegradable urns, cremation, and sustainable burial practices is influencing insurance product structures.

Customizable Add-Ons

Riders for memorial services, legal aid, and grief counseling are becoming popular.

Blockchain for Claims Processing

Pilot initiatives are exploring blockchain to speed up death claim verification and reduce fraud.

🧩 Strategic Recommendations

Expand Digital & Mobile Sales Channels for tech-savvy and remote buyers.

Partner with Funeral Homes & Healthcare Networks to offer bundled products.

Offer Multilingual Support & Culturally Sensitive Plans for ethnically diverse populations.

Develop Flexible Premium Structures for various income brackets.

Educate Younger Adults (Age 40+) to build long-term customer relationships.

🧾 Conclusion

The global burial insurance market is gaining momentum as aging demographics, rising end-of-life expenses, and emotional financial planning converge. With its mix of accessibility, affordability, and peace of mind, burial insurance is no longer just for the elderly—it is becoming a mainstream financial planning product. Companies that adapt to digital channels, customer education, and cultural needs are positioned to thrive in the expanding funeral economy.

More Trending Reports by Zion Market Research -

Travel Medical Insurance Market

Aviation Insurance Market

Deepak Rupnar

Zion Market Research

+1 855-465-4651

richard@zionmarketresearch.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.