Interest Rate Swaps Market: Size, Share, Growth Drivers and Emerging Trends 2025–2032

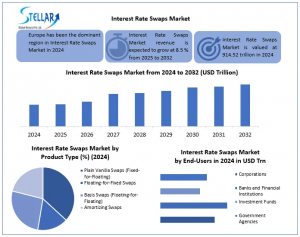

Interest Rate Swaps Market was valued at USD 469.2 trillion in 2024 and is expected to reach USD 967.15 trillion by 2032, at a CAGR of 8.7% 2025-2032.

Interest Rate Swaps Market is forecast to grow to USD 967.15 trillion by 2032 from market drivers such as central clearing efficiency, innovation in hedging, and active cross-currency swap activity.”

MIAMI, FL, UNITED STATES, October 30, 2025 /EINPresswire.com/ -- The Interest Rate Swaps Market was valued at USD 469.2 Trillion in 2024 and is expected to reach USD 967.15 trillion by 2032, growing at a CAGR of 8.7% during the forecast period 2025–2032.— Navneet Kaur

Interest Rate Swaps Market Overview:

An Interest Rate Swap (IRS) Market is a derivative transaction in which two counterparties swap interest payment cash flow streams, typically fixed against floating cash flows, which can be used to reduce interest rate risk or borrowing cost. As a derivative transaction, the IRS market is executed in an Over-the-Counter (OTC) market, providing trading flexibility and customization that may not otherwise be available through standardized exchange-traded derivatives. The IRS market is crucial to global financial risk management as it allows banks, corporations, and investors to hedge against changes in interest rates or take advantage of changes in interest rates.

Interest Rate Swaps Market Dynamics

Differences in Monetary Policy Generate Market Opportunities

Differences in monetary policy between major central banks - such as the U.S. Federal Reserve remaining on hold, whereas the ECB and others begin to ease in early 2025- create an opportunity in the IRS market due to differences in monetary policy contributing to cross-currency swaps and basis trades as market participants hedge or speculate on a widening interest rate spread across economies.

👉 Access the full Research Description at: https://www.stellarmr.com/report/req_sample/interest-rate-swaps-market/2849

Increased Flexibility in Hedging Creates Market Opportunities

Interest Rate Swaps ("IRS") are an OTC and customizable instrument that offers flexibility not found in exchange-traded instruments. Participants can customize notional amounts, maturities, and reference rates, which offer precise hedging against interest rate risk and a greater amount of flexibility than exchange-traded instruments.

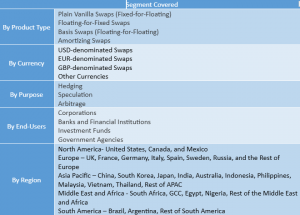

Interest Rate Swaps Market Segment Analysis

By Product Type: Plain Vanilla Swaps (Fixed-for-Floating) lead the market, making up 60-75% of total IRS volumes. Their low complexity, high transparency, and enhanced liquidity justify the adoption of Plain Vanilla Swaps as the leading type of swap. The use of Risk-Free Rates (RFRs), including SOFR, has reaffirmed the role of Plain Vanilla swaps as the global standard for interest rate risk management.

By Currency: Market volume is led by swaps denominated in USD, followed closely by swaps denominated in EUR. The U.S. dollar continues to be the global standard; however, changing monetary policy and expanding European markets have contributed to higher volumes in EUR swaps, which may lead to a currency mix that is more balanced and diverse.

By Purpose: Hedging is the primary purpose for banks, corporations, and financial institutions when using Interest Rate Swaps, as they seek to stabilize cash flows and reduce volatility inherent in floating interest rates. Interest Rate Swaps are effective financial instruments for managing interest rate risk and are vital to help achieve predictable financial outcomes in addressing asset-liability mismatches.

By End User: The largest end user in the market is banks and financial institutions that use Interest Rate Swaps to manage balance sheet exotic exposure, adjust interest rate sensitivities, and assure funding certainty. Corporations and investment funds also utilize the IRS for opportunistic risk management and yield generation.

Interest Rate Swaps Market Regional Analysis

Europe Dominates the Global Market

The global interest rate swaps market is primarily led by Europe, based on the integrated Eurozone economy, large liquidity pools in London, Frankfurt, and Paris, and relevant and widely referenced interbank rates such as EURIBOR. The strong regulatory regime, including the European Market Infrastructure Regulation (EMIR), supports this market structure through central clearing and more information on clearing and execution.

Interest Rate Swaps Market Competitive Landscape

The interest rate swaps market is highly concentrated within global financial institutions, including J.P. Morgan, Goldman Sachs, Citigroup, Morgan Stanley, Deutsche Bank, and UBS. These institutions act as key market makers, supporting the market with liquidity and execution speed. Furthermore, the share of the market has consolidated as a result of bank mergers, including UBS acquiring Credit Suisse. As of 2024, approximately 81.7% of traded notional was centrally cleared, indicating a strong integrity of market structure and a regulatory framework.

👉 Access the full Research Description at: https://www.stellarmr.com/report/req_sample/interest-rate-swaps-market/2849

Recent Development

Mar 22, 2024: RFR Transition Matures: Eighty-one-point nine percent of fixed-for-floating IRS notional cleared by early 2025, with SOFR settling into the USD market standard.

Jul 24, 2023: Policy Divergence Effect: ECB rate cuts & Fed's stability widened global rate differentials, impacting cross-currency swap pricing.

FAQs

What is the estimated size of the Interest Rate Swaps Market?

The Interest Rate Swaps Market was approximately USD 469.67 Trillion in 2024 and is expected to reach USD 967.15 trillion by 2032, at a CAGR of 8.7% from 2025 to 2032.

Which companies hold the major share of the market?

Leading players consist of J.P. Morgan, Goldman Sachs, Citigroup, Deutsche Bank, UBS, and HSBC, all of which carry the title of global market makers in interest rate derivatives.

What are the next major trends in the Interest Rate Swaps Market?

Key trends include the transition to Risk-Free Rates (RFRs) such as SOFR and €STR, a rise in central clearing, and a rise in cross-currency swap activity given the ongoing evolving policy divergence.

Which region is leading the global market?

Europe leads in the Interest Rate Swaps Market, given its considerable financial infrastructure, Euro-denominated liquidity, and strong regulatory regime.

Who are the main end-users of interest rate swaps?

Banks and financial institutions are the largest users, followed by corporations and investment funds, utilizing swaps for hedging, balance sheet management, risk diversification, and arbitrage.

Key Players in the Rainwear Market

North America

J.P. Morgan (United States)

Citigroup (United States)

Goldman Sachs (United States)

Morgan Stanley (United States)

Bank of America (United States)

Wells Fargo (United States)

TrueEX (United States)

CME Group (United States)

BGC Group / FMX (United States)

TradeWeb (United States)

Europe

Deutsche Bank (Germany)

Barclays (United Kingdom)

HSBC (United Kingdom)

BNP Paribas (France)

Société Générale (France)

UBS (Switzerland)

Credit Suisse (Switzerland)

NatWest Group (United Kingdom)

Danske Bank (Denmark)

Crédit Agricole CIB (France)

Asia-Pacific

Nomura Holdings (Japan)

Mizuho Financial Group (Japan)

Sumitomo Mitsui Financial Group (Japan)

Agricultural Bank of China (China)

Bank of China (China)

Industrial and Commercial Bank of China (China)

China Construction Bank (China)

DBS Bank (Singapore)

Middle East & Africa

Standard Chartered (MEA)

South America

Banco Santander Brasil (Brazil)

Stellar Market Research is launching a subscription platform for the Global Interest Rate Swaps Market, providing comprehensive data, insights, and analysis to help financial institutions and investors.

https://www.stellarmr.com/report/interest-rate-swaps-market/2849

Related Reports:

Energy Trading and Risk Management Market: https://www.stellarmr.com/report/energy-trading-risk-management-market/2830

Angel Funds Market: https://www.stellarmr.com/report/angel-funds-market/2819

Debt Recovery Services Market: https://www.stellarmr.com/report/debt-recovery-services-market/2816

Credit Scoring Market: https://www.stellarmr.com/report/credit-scoring-market/2809

Prompt Engineering Market: https://www.stellarmr.com/report/Prompt-Engineering-Market/2801

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Lumawant Godage

Stellar Market Research

+ +91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.